A simple and free Excel tool to manage your personal finances

Do you ever wonder where all your money goes?

Why you’re always broke?

Why you can never seem to put any money aside for savings?

Maybe now is the time to create a budget.

But how?

We have created a free tool to help you.

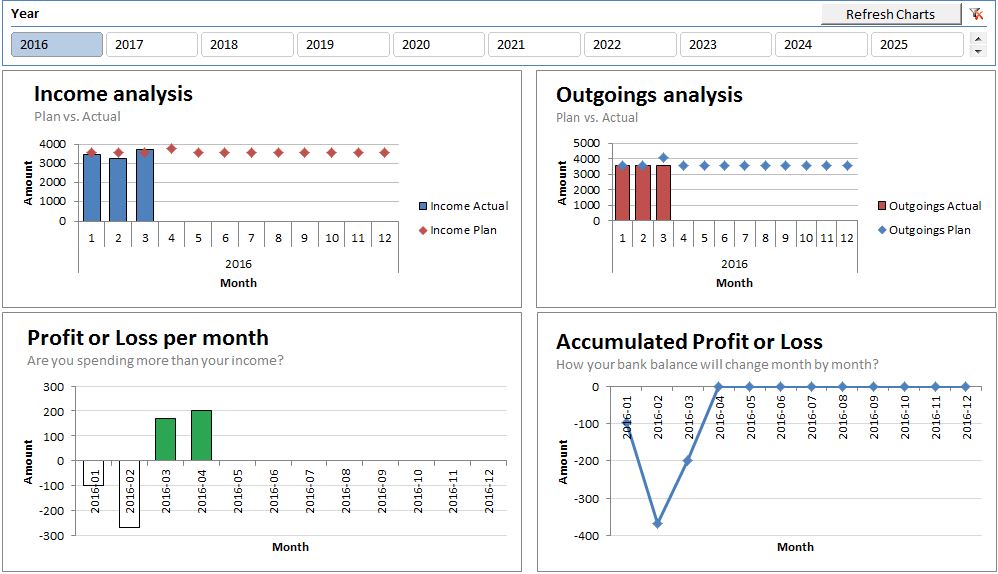

It’s very simple to use. Simply enter in all of your income each month, and all of your planned expenses (or outgoings). Then as each month happens, record the actual income and expenses. By entering this information you can then compare where you think you should be spending money, and where you actually are spending it.

There is also a dashboard to help you visualise the money you could save over time if you keep to your budget.

Over time you will find you are better at planning your money, and your actual spend is closer to your planned spend.

After opening, please ensure you set the start date for planning in cell B4 of the income sheet. The tool will then give you 10 years of financial planning from this date. You will need to have macros enabled to ensure the dashboard charts are automatically updated with your latest budget information.

That’s about it. It really is that simple, but if you have any questions then please leave them in the comments box below so we can answer them for everyone to see.

Enjoy 🙂

Video guide

Here is a full video demo of how to use the budget…

One response

A couple of suggestions on the very good, easy to use tool.

1. Add colour to the worksheet TABs to coincide with Column B (Category) of that worksheet

2. In Outgoings, in Column B, Colour code Direct Debits as one colour and then variable spend another. I thought that would help when completing actuals. In fact you could take this principle to the Income tab where you are receiving incomes from different categories. So Salaries are one; Pensions are another etc. I have 3 categories of income so it helps me.